Happy New Financial Year! Super and the tax system is an ever-changing landscape and this year is no different. This article will summarise the changes that took effect on the 1st of July 2022.

As of the 1st of July, the Superannuation Guarantee (SG) increased from 10% to 10.5%.

This is good for employees as there is more money being contributed into the low tax environment of Super for your retirement. Most people got a pay rise. However, some people may not have and will need to check the wording of their contract. If your contract states a ‘total package’ amount, you may have got an increase in SG but a decrease in your wage or salary to reflect the same total package. This SG increase is not so good for business owners as they have to pay employees more and the Super Guarantee rate is legislated to go up by 0.5% on the 1st of July each year until 2025. It will then stay at 12% going forward from that date.

If you have a salary sacrifice arrangement in place with your employer and you were salary sacrificing up to the concessional contribution cap of $27,500 in the last financial year you may need to amend the agreement. This could now push you over the threshold if you do not have available catchup contributions and there will be extra tax to pay.

The monthly income threshold of $450 to receive Super Guarantee contributions has been removed.

This makes it fairer so that anyone earning an income will receive Super Guarantee contributions from their employer and they no longer have to earn over $450 to receive the SG. This affects mainly young workers, part-time workers and elderly workers. Often someone might have a second job and only work a few hours per month, this will ensure they are receiving the Super Guarantee they deserve for the work done. A great change in my opinion making Super more accessible and fairer for everyone. This is also a great reminder to consolidate your Super if you have multiple accounts and are wasting money paying multiple sets of fees.

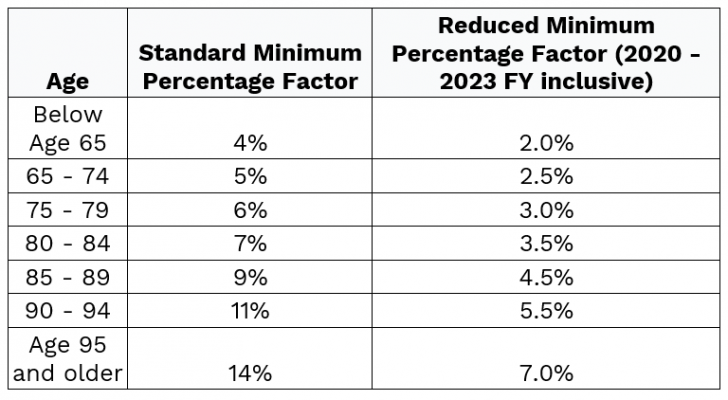

The 50% account-based pension minimum drawdown has been extended for the 2022-23 financial year.

The 50% reduction in the required minimum drawdowns from pension accounts has been extended for the 2022-23 tax year due to ongoing adverse financial conditions.

This obviously means that you do not have to withdraw as much as normal and this may be a welcome relief for many, considering markets are down.

Table: Minimum yearly required drawdowns for Account Based Pensions

This reduced drawdown can help to mitigate sequencing risk. The negative effects of this can be experienced when you sell when markets are down (you are forced to sell in pension phase) and this can accelerate the depletion of your funds. The sequence of returns really matters when you are close to, or are in early retirement. This can mean the difference between being self-funded in retirement and relying on the age pension if the sequence of investment returns is not favourable.

The work test has been abolished for after-tax contributions (non-concessional contributions) for people aged 67 to 74.

This is an excellent opportunity to get more money into the low tax Superannuation environment. Initially, you have to make these after-tax contributions into an accumulation account (because you can’t make contributions to a pension account). But you can then transfer them into pension phase, which is a tax-free environment.

Previously individuals in this age group had to satisfy the work test to have an accumulation account. This is where you must be employed for 40 hours of work over a consecutive 30-day period during the year when the contributions were made. This no longer applies, so if you are retired you can now get more money into Super where previously your options were limited. The work test removal does not extend to pre-tax concessional personal deductible contributions.

If you receive a lump sum from an inheritance or sale of an asset, you can contribute it into the tax-effective environment of Super rather than paying tax at your marginal tax rate whether you are working or now retired.

Within this you can utilise the bring forward provisions contributing an after-tax lump sum of up to $330,000 without having to be employed anymore. This utilises this year’s after-tax cap and the next 2 financial years’ caps.

This will not be possible once you turn age 75.

This is also an excellent opportunity for a Re-contribution strategy. This helps reduce the tax payable from super death benefits that are received by non-tax dependants like adult children for example. This can reduce the 15% tax plus the 2% Medicare levy to 0% as you are converting the funds from a taxable component (SG, salary sacrifice & personal deductible contributions) of your Super to a tax-free component (non-concessional contributions). Then there is no tax to pay when distributed upon death to a non-tax dependant.

Example:

Say you have $330,000 in your pension account and the whole account is made up of a taxable component that you don’t believe you will need and are expecting to pass on to your adult children. You could withdraw the $330,000 into your own bank account and then recontribute the maximum non-concessional amount of $330,000 in a lump sum (utilising the bring forward provisions) into your accumulation super account which would now be classed as a tax-free component. Then you would transfer it back to pension phase. This way it remains in the 0% pension tax environment rather than paying tax up to the maximum of 15% in accumulation phase and it washed out the tax payable upon death to a non-tax dependant.

Instead of paying $56,000 in super death benefits tax ($330,000 * 17%) when it is distributed to a non-tax dependant upon death, you would pay $0 tax. A $56,000 tax saving or $56,000 more has gone to the eligible person of your choosing. If you are a couple and you both do this re-contribution strategy, that is a $112,000 and is a considerable extra benefit to a loved one.

And if it turns out that you did need the money for your retirement, it is still available.

Plus, you can do the same thing every 3 years before you turn 75 if you have available funds.

There are some extra things to be aware of so always discuss this with a licensed financial adviser.

Home Downsizer Contribution eligibility has been reduced from age 65 to age 60.

This scheme allows you to put up to $300,000 into super from the proceeds of the sale of your Principal Place of Residence. For more information on how the Downsizer contributions work, have a look at this Nucleus Wealth Empower podcast we did recently. Please also see the ATO website here for more information on eligibility.

This aligns more closely to most people’s preservation age which is a condition of release and when they are able to access their Super. This makes more sense as many people have substantial equity built up in their homes and may want to release this and put it into the tax-free environment of Super in the pension phase and retire earlier than traditional retirement at age 65.

The First Home Super Saver Scheme (FHSSS) has increased from $30,000 to $50,000 of voluntary contributions that can be released to purchase your first home.

You can see another Nucleus Wealth Empower podcast episode here on how the FHSSS works.

Housing is expensive in Australia and many first-home buyers struggle to save a deposit. This change will allow people to save more for their first home in a tax-effective way.

You can see the changes in more detail here.

The Home Equity Access Scheme now allows advance lump sum payments and now guarantees that the debt will never exceed the market value of the home.

Many retirees have a large amount of their wealth tied up in their home and this scheme allows eligible retirees to get a voluntary non-taxable loan using Australian real estate as security. This is intended to supplement your retirement and access the equity in your home without having to sell your home. You can see the full details of the scheme here

Usually, you get fortnightly payments, but now you can also get an advanced payment if you need a lump sum. This is great because if unexpected circumstances come up like medical expenses or home maintenance, you can access your equity to pay for it if you don’t have other available funds. This makes the scheme more flexible and attractive to the changing needs in retirement.

Additionally, when you repay the loan, a no negative equity guarantee will now apply. This is a welcome change as many people have gotten into stressful negative equity situations in the past and this makes the Home Equity Access Scheme safer and less risky. There are considerable risks with reverse mortgage type products, so please always discuss this with a licensed financial adviser.

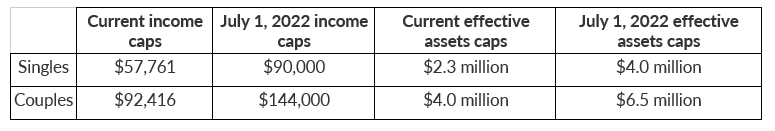

Commonwealth Senior Health Card (CSHC) eligibility is increasing significantly.

The CSHC entitles retirees to many generous benefits like bulk billing for Dr visits, cheap prescriptions, refunds on medical costs, lower utility bills, reduced property, water & rates bills, cheaper public transport plus many other benefits.

About 50,000 extra wealthy Australians will soon be eligible for CSHC. This was an election promise made by both major parties, although this has not yet been legislated, it will be coming very soon. There is no assets test but a deemed income test. The income caps for eligibility are increasing from $56,761 to $90,000 for singles and from $92,416 to $144,000 for couples. If you earn under these amounts and don’t receive any pension, you will be eligible. The deeming rates that were halved during the pandemic have been frozen and extended for another 2 years. It is 0.25% p.a for the first $56,400 for a single and 0.25% for the first $93,600 for a couple. Then anything over those amounts is deemed at 2.25% p.a. Even if you earn more than the deemed amount, it still gets calculated at the deemed rate.

With these new changes coming into effect, this will mean if you are single, you can now have up to $4 million outside of your family home (exempt from the income test) and still be eligible for the CSHC. If you are a couple, you can have up to $6.5 million outside of the family and still receive the CSHC.

Table: Eligibility for Commonwealth Senior Health Card

The people benefiting are some of the wealthiest in society who arguably need these concessions the least. It seems the ones benefiting are often the influential mates of the people making the rules and that’s maybe why both political parties made these promises. Is this giving extra perks to the wealthy in the hope they will support them?

Final thoughts

The government is making it easier for people to get money into Super.

It is already a generous system and it seems to be getting more generous. There are already a lot of tax benefits available and some more that can now be exploited. Are they unintended consequences like the re-contribution strategy or just straight out giving benefits to the wealthy, like the generous new rules for the Commonwealth Seniors Health Card?

Does this demonstrate that the government wants people to be self-funded retirees through generous concessions? Or is this just giving more concessions and tax savings to the wealthy, even though they benefit the most but need it the least?

I will leave it up to you to decide.

If you would like to discuss any of these changes in more detail, please book an appointment with me as I am always happy to have a chat. If you would like a more personal conversation about investing with Nucleus Wealth, please also book an appointment with me as I love talking about investing and the power of compounding.

Samuel Kerr is the Senior Financial Adviser at Nucleus Wealth.

The information on this blog contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance. Samuel Kerr is an Authorised Representative of Nucleus Advice Pty Limited, Australian Financial Services Licensee 515796. And Nucleus Wealth is a Corporate Authorised Representative of Nucleus Advice Pty Ltd.